How to Avoid Fees

We get it, no one likes fees. Explore tips and tricks for how to avoid them.

Your best interest is our top priority.

Whether it means helping you avoid a declined debit card or bounced check, getting you money when you need it, or giving you tools to monitor your money and keep your accounts secure.

We are a not-for-profit organization that’s owned by you—our members.

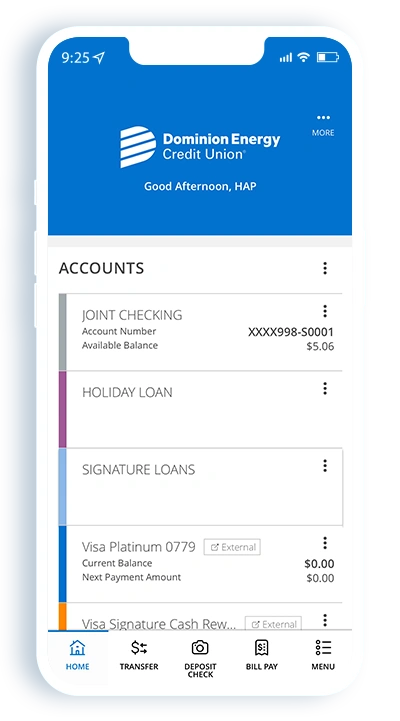

Easily monitor and manage your money

Regularly check your account to ensure you always have enough funds.

- Check account balances

- Transfer funds between accounts

- Monitor your budget and spending habits

- Sign up for transaction and balance alerts

- Access online statements and account history to identify any previous positives or pitfalls

- Make payments with peace of mind knowing your account balance can cover

✓ WHY IT WORKS

Avoid your account dipping down below any minimum balance requirements.

Life happens. You forget about a recurring bill. You have an unexpected emergency.

We’ve got your back with overdraft protection that connects your checking to a savings account, so you can skip the non-sufficient fund fees.

✓ WHY IT WORKS

Instead of making a negative draw on your account, you’ll automatically be covered by another connected account or source of funds.

We'll make up the difference until you can pay us back.

If you accidently overdraw on your account using your Visa® Debit Card and overdraft protection can’t cover your transaction, Courtesy Pay is an additional safety net.

- No fee until you actually use this service

- Significantly lower fees than most major banks

✔ WHY IT WORKS

Sometimes, your savings may not be able to cover the total amount of an over withdrawal.

We participate in a network of surcharge-free ATMs, helping you save money.

- Visit over 80,000 CULIANCE no-surcharge, deposit taking ATMs and certain CO-OP Shared Branch locations**

- Make basic teller transactions at CO-OP Shared Branches nationwide

- Avoid fees at Dominion Energy Credit Union, Wawa, Sheetz, and North Carolina CashPoints ATMs

Find surcharge-free ATMs or a Credit Union Service Center near you. Can't find one near you? That's ok. You can still withdraw without worry. Get up to $6 in rebates each month for out-of-network ATM fees*.

✔ WHY IT WORKS

ATM fees are typically charged when you use an out-of-network ATM.

Make sure your money gets into your account on time.

Choose to have funds go directly from your paycheck into your DECU checking and savings accounts, so you can withdrawal without worry and grow your savings safety net for the unexpected.

✔ WHY IT WORKS

Your paycheck and recurring deposits will hit your account on an expected schedule, so you know your have enough money in your checking to cover expenses.

If you change your home address, name, email or phone number, don’t forget to tell us! If your account is accruing charges for common fees, we want to be sure you know and can avoid them going forward.

✔ WHY IT WORKS

If we can’t contact you and you’re not receiving fee notifications, you won’t know and therefore won’t be able to fix and find a solution.

Get real-time alerts for low balances or large withdrawals, and stay informed about transactions hitting your account to avoid an overdraft.

✔ WHY IT WORKS

It can be a handy reminder if you forgot about an upcoming debit that could put you in the negatives (plus, it can help prevent fraud!).

You’ll get access to your account statements sooner and securely without the added cost of paper and postage.

✔ WHY IT WORKS

It can be a handy reminder if you forgot about an upcoming debit that could put you in the negatives.

Open a free checking account with eStatements and overdraft protection.

- No minimum balance requirement or monthly service fee

- Manage your account on the go with Digital Banking, Bill Payer, and Mobile Deposit

- Use nationwide shared branches and avoid charges at no-surcharge ATMs

- Free Visa® Debit Cards for convenient online and in-store purchases, plus it's always free to get cash back!

- Set up Automatic Deposits to fast-track your paycheck and build up savings

- Enjoy free overdraft protection linked to savings

FAQs

Overdrawing an account means spending more money than you have available in your checking account at the time. This can happen when a debit card transaction exceeds your current available balance, causing your total funds to fall below zero.

*DECU will reimburse up to two ATM surcharges (ATM owner fees) incurred per month on withdrawals from a checking account using your DECU debit card up to a maximum of $3 per withdrawal for a maximum refund of $6/month. Please note: the ATM owner may charge a fee. Rebates will be given automatically at month-end.