Avoiding Card Skimmers

- Financial Security

What is skimming?

ATM card skimming is a method used by criminals to capture data from the magnetic stripe on the back of an ATM card. The devices used are smaller than a deck of cards and are often fastened in close proximity to or over the top of an ATM’s factory-installed card reader.

What is PIN capturing?

PIN capturing refers to a method of strategically attaching cameras and various other imaging devices to ATMS in order to fraudulently capture the ATM user’s PIN.

When does skimming occur?

Criminals tend to attach skimming devices either late at night or early in the morning, and during periods of low traffic. The devices are usually attached for a few hours only. Criminals install equipment on at least 2 regions of an ATM to steal both the ATM card number and the PIN. They then sit nearby receiving the information transmitted wirelessly via the devices.

How do I know if an ATM has been tampered with?

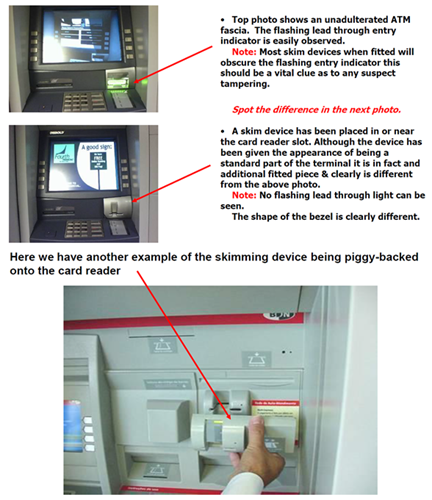

- Inspect the front of the ATM for unusual or non-standard appearance. Scratches, marks, adhesive, or tape residues could be indicators of tampering.

- Check to see if the machine looks like a fake part has been fitted over it. Common examples include: light diffuser area, speaker area, ATM side fascia, card reader entry slot, and ATM keyboard area. See next page for examples.

Do I need an aluminum card sleeve?

It depends on the type of card you have. If you have a regular magnetic stripe card or an EMV chip card (which includes the majority of cards), no, you do not need to wrap your card in aluminum to protect your information. The only card you maybe want to consider an aluminum sleeve for is a card using radio frequency identification, or RFID, which is no longer heavily utilized anyway. The frequency technology in these contactless cards makes it easier for criminals to obtain card information than from your traditional credit card. EMV chip cards, on the other hand, are vastly different with greater built-in security features.

What does a skimmer look like?

As noted above, a skimming device can be fitted to various parts of an ATM machine, so it may be difficult to spot unless you are familiar with a local ATM. We recommend using ATMs inside buildings, preferably inside the branch.

How can I defend myself against skimmers?

- Hold your hand over the keyboard when entering your PIN anywhere, even if you think you are alone. There may be a camera nearby.

- Keep your cards face down in your wallet so that when you open it, the numbers aren’t visible.

- When swiping your card for a purchase, hold your thumb over the card number—again, to avoid cameras.

- Check your accounts every couple days—or even better, daily. Online and mobile banking make it very easy to quickly check your transaction history.

- When traveling, alert your card company to put a notice on your account that your card will be used in a different state or country.

- Never announce on social media that you will be traveling or are currently on vacation.

- When paying with your debit card, select "credit" wherever possible so you do not have to enter your PIN. Your magnetic strip may still be read by a skimmer, but the hidden camera will not have captured your PIN information.

- For example, severe skimming attacks have recently taken place at gas stations. Criminals make copies of the master key codes to the gas pumps, open up the gas pump card readers, and insert the skimmers, which are completely invisible to staff and customers. The skimmer steals the magnetic strip information, and a hidden camera videos your hand at the PIN pad.