Comparing Savings Options

- Money Management

Comparing Savings Options

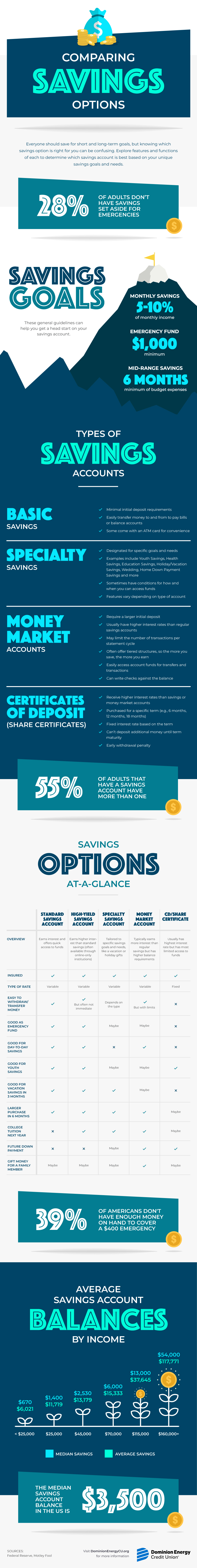

Everyone should save for short and long-term goals, but knowing which savings option is right for you can be confusing. Explore features and functions of each to determine which savings account is best based on your unique savings goals and needs.

28% of adults don't have savings set aside for emergencies

Savings Goals

These general guidelines can help you get a head start on your savings account.

Monthly Savings

5-10% of monthly income

Emergency Fund

$1,000 minimum

Mid-range Savings

6 months minimum of budget expenses

Types of Savings Accounts

Basic Savings

Minimal initial deposit requirements

Easily transfer money to and from to pay bills or balance accounts

Some come with an ATM card for convenience

Specialty Savings

Designated for specific goals and needs

Examples include Youth Savings, Health Savings, Education Savings, Holiday/Vacation Savings, Wedding, Home Down Payment Savings and more

Sometimes have conditions for how and when you can access funds

Features vary depending on type of account

Money Market Accounts

Require a larger initial deposit

Usually have higher interest rates than regular savings accounts

May limit the number of transactions per statement cycle

Often offer tiered structures, so the more you save, the more you earn

Easily access account funds for transfers and transactions

Can write checks against the balance

Certificates of Deposit (Share Certificates)

Receive higher interest rates than savings or money market accounts

Purchased for a specific term (e.g., 6 months, 12 months, 18 months)

Fixed interest rate based on the term

Can't deposit additional money until term maturity

Early withdrawal penalty

55% of adults that have a savings account have more than one

Savings Options At-A-Glance

Standard Savings Account: Earns interest and offers quick access to funds, insured, variable rate, easy to withdraw/transfer money, good as emergency fund, good for day-to-day savings, good for youth savings, good for vacation savings in 3 months, larger purchase in 6 months, not good for college tuition next year, not good for future down payment, maybe good for gift money for a family member

High-Yield Savings Account: Earns higher interest than standard savings (often available through online-only institutions), insured, variable rate, easy to withdraw/transfer money but often not immediate, good as emergency fund, good for day-to-day savings, good for youth savings, good for vacation savings in 3 months, larger purchase in 6 months, good for college tuition next year, not good for future down payment, maybe good for gift money for a family member

Specialty Savings Account: Tailored to specific savings goals and needs, like a vacation or holiday gifts, insured, variable rate, easy to withdraw/transfer money depending on the type of account, maybe good as an emergency fund, not good for day-to-day savings, maybe good for youth savings, good for vacation savings in 3 months, good for larger purchase in 6 months, good for college tuition next year, maybe good for future down payment, maybe good for gift money for a family member

Money Market Account: Typically earns more interest than regular savings but has higher balance requirements, insured, variable rate, easy to withdraw/transfer money but with limits, maybe good as an emergency savings fund, good for day-to-day savings, maybe good for youth savings, maybe good for vacation savings in 3 months, good for larger purchase in 6 months, good for college tuition next year, good for future down payment, good for gift money for a family member

CD/Share Certificate: Usually has highest interest rate but has most limited access to funds, insured, fixed rate, not easy to withdraw/transfer money, not good as an emergency fund, not good for day-to-day savings, good for youth savings, not good for vacation savings in 3 months, maybe good for larger purchase in 6 months, maybe good for college tuition next year, good for future down payment, maybe good for gift money for a family member

39% of Americans don't have enough money on hand to cover a $400 emergency

Average Savings Account Balances By Income

Less than $25,000

Median savings: $670

Average savings: $6,021

$25,000

Median savings: $1,400

Average savings: $11,719

$45,000

Median savings: $2,530

Average savings: $13,179

$70,000

Median savings: $6,000

Average savings: $15,333

$115,000

Median savings: $13,000

Average savings: $37,645

$160,000+

Median savings: $54,000

Average savings: $117,771

The median savings account balance in the U.S. is $3,500

Sources:

Federal Reserve, Motley Fool

Visit DominionEnergyCU.org for more information

Dominion Energy Credit Union