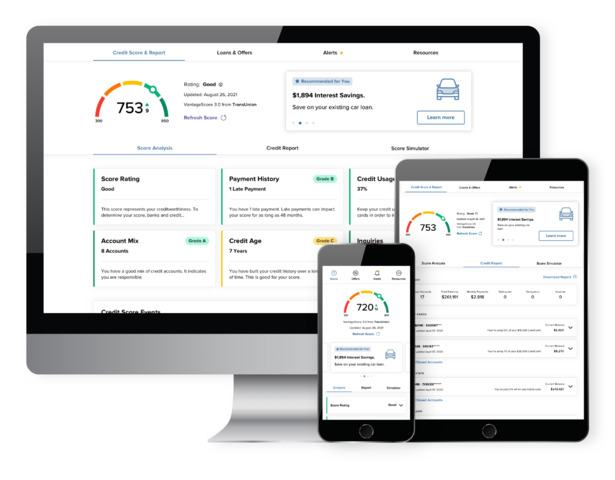

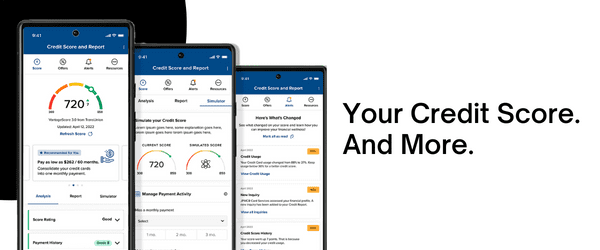

Credit Score & More

Staying on top of your credit score has never been easier with our free, ongoing credit score report and monitoring program.

You can refresh your score daily for real-time updates. You won't be penalized for checking your score daily because it's simply a soft inquiry.

Your credit score can affect whether you get a loan, a home, or even a job

Lenders use your score to determine your creditworthiness, meaning how reliable you are when it comes to paying back debts on time. The higher your credit score, the lower the rate you pay on loans, and the more money you save. Credit Score and More gives you a detailed look at this important data so you can monitor your score and keep it as high as possible. Simply opt-in for the free Credit Score service within Digital Banking to get started.

- Free, daily access to your credit score

- Real-time credit monitoring alerts

- Credit score simulator

- Personalized credit report

- Special credit offers

Frequently Asked Questions

Credit Score and More helps you stay on top of your credit by providing your latest credit score and report and understanding key factors that impact the score. It also monitors you credit daily and informs you by email if any significant changes are detected, such as a new account being opened, a change in address, employment, delinquency, or inquiry has been reported.

Yes. Credit Score and More will monitor and send email alerts when there has been a change to your credit profile.

Credit Score and More is entirely free to Dominion Energy Credit Union members.

Credit Score and More is a “soft inquiry” which does not affect a credit score. Lenders use “hard inquiries” to make decisions about creditworthiness when you apply for loans.

SavvyMoney pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

The SavvyMoney Credit Score makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong or inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com, and then pursuing with each bureau individually. Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within their SavvyMoney Credit Report. However, The Federal Trade Commission website offers step-by-step instructions on how to contact the bureaus and correct errors.

Financial education and resources to support your success

Better than ordinary checking

Enjoy our free checking account with eStatements, no hidden fees and access to powerful digital tools.

Dominion Energy Credit Union, headquartered in Richmond, Virginia, is a full-service financial institution that serves Dominion Energy employees and offers convenient digital banking services and Bill Payer so members can manage their money from anywhere.