The Dominion Energy CU Difference

More than a smart place to do your banking, we're also your co-worker, your friend, and your financial partner.

Energizing your future

We have a long history of serving Dominion Energy employees, and we understand your specific needs. When you call on us, it's like calling an old friend who will go above and beyond to help.

Who We Are

We're a not-for-profit, member-owned financial cooperative that focuses on members like you. We offer the same personal financial services as the big banks, but with better rates, fewer fees, and more personal attention.

- Our passion is not profit, but giving you the best deal possible

- We're dedicated to offering guidance and tools you need to reach your goals

- We specialize in attentive, efficient service, no matter where you are

Since our beginning, we’ve cultivated steady, sensible growth. We now have more than $350 million in assets and more than 21,000 members throughout all 50 states. With this growth, we’ve never lost sight of our commitment to serving Dominion Energy employees, and to creating a level of trust so that you look to us first for your financial needs.

As a member, be assured you made a wise decision to put your money somewhere safe.

Your deposits are federally insured up to at least $250,000 through the National Credit Union Administration (NCUA), just like the protection offered by the Federal Deposit Insurance Corporation (FDIC). Options are available for members with more than $250,000. Learn more at MyCreditUnion.gov.

Dominion Energy Credit Union has always been responsive to the specific needs of Dominion Energy employees in a number of ways, including:

- Offering special loans through Dominion Energy CU to employees affected by natural disasters

- Awarding scholarships to outstanding students every year

- Accommodating workers during storms by offering extended services

- Placing ATMs in company buildings that might be considered "too small" by bank standards

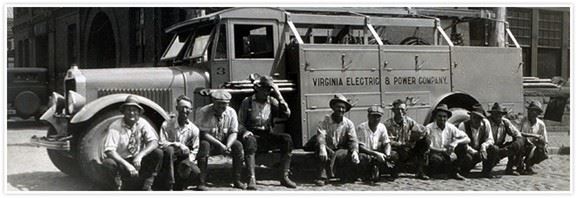

A midnight game of poker leads to what is now Dominion Energy Credit Union.

In 1940, a handful of Virginia Public Service Co. employees, who called themselves The Foreman’s Club, were in hot water after playing one too many hands of poker. They were short on cash when it came time to settle at the end of the night.

Back in those days, one couldn’t come by a small cash loan easily. The employees began looking into creating something called a “credit union” that would enable them to save and borrow with each other, at better rates than elsewhere. Dominion Energy Credit Union was formed solely to help employees take control of their finances and make a better life for themselves and their families.

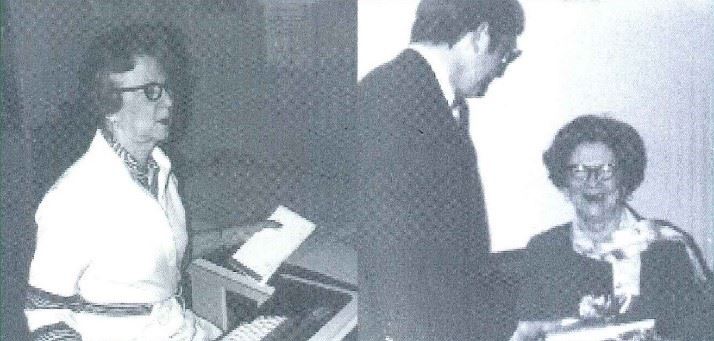

Personal Service and Trusted Advice

In our early years, Dominion Energy Credit Union was run out of Dominion Energy’s Payroll Department. From the mid 1960s to 1980s, a single employee, Mary Broaddus, maintained all credit union business in a box of files she carried on a rolling cart. The only way to access money was to ask Mary for a check. Over the years, Mary became known for her incredible personal service and sage advice about the value of saving over spending.

Exponential Growth with the Same Member Focus

In the 1980s, the credit union started on its current path of consistent growth as we added a full range of services, expanded membership to include retirees, contract workers, and family members, and enhanced convenience through the latest technologies. Our mission, though, remains: to improve the financial well-being of our members by offering products and services that benefit them.

Dominion Energy Credit Union continues to evolve to meet members' needs.

Members can access their accounts anytime, anywhere with our digital services and through an expanded list of ATMs, shared branches and service centers nationwide. The credit union now also offers several mortgage options to employees in VA, NC, SC, and OH, making it more affordable than ever to buy a home.

While we continue to grow and add new services to meet the changing needs of our members, we remain committed to treating each member as an individual. Join today, and discover The Dominion Energy Difference.

We exist for the sole benefit of you, our member.

- It is our mission to improve your financial well-being by offering products and services that benefit you.

- We will fulfill this mission using our guiding principles of trust, convenience, excellent service, professionalism, and financial soundness.

- Our vision is to provide you with services that are easy to use, accessible, and a good value.

- We will offer fair deals and a range of low-cost financial services to meet your needs.

- We will always treat you with dignity and respect.

- We will communicate our services clearly. We will also be up front and honest about our services, always disclosing the facts.

- We will place importance on consumer education and strive to help you meet your financial goals.

- This statement of Commitment to our Members ensures the strength, stability, and continued success of the credit union for your benefit.

A volunteer Board of Directors, composed of fellow Dominion Energy members elected by other members, governs all we do. Our board and management team work diligently to ensure the credit union remains financially stable while honoring our mission to improve the lives of our members.

Executive Staff

- Afua Essandoh, President/CEO

- Kristopher S. Morelli, Executive Vice President, Information and Payment Systems

- Paullar A. Skinner, Vice President, Operations

- Natalie W. Baker, Vice President, Marketing

Board of Directors

- Edward H. Baine, Chair

- W. Keith Windle, Vice Chair

- Afua Essandoh, Secretary/Treasurer

- Carlos M. Brown

- Felicia Howard

- Steve C. Wooten

- Utibe Bassey

- Iris Griffin

- Thomas Arruda

Other Volunteers

- Edward Y. Price, Chair Emeritus

- Ken Barker, Chair Emeritus

- Deborah Johnson, Director Emeritus

- Becky Merritt, Director Emeritus

Supervisory Committee

- Jack Risendal, Chair

- Tanya Ross

- Kelly Conway

Financial education and resources to support your success

Small change. Large savings.

Save more each year by switching to Dominion Energy Credit Union, plus get access to everything we have to offer.

Dominion Energy Credit Union, headquartered in Richmond, Virginia, is a full-service financial institution that serves Dominion Energy employees and offers competitive rates on savings, loans, credit cards, and mortgages.