The Greatest Financing on Earth

Now is a great time to buy or refinance! Offer ends 5/31.

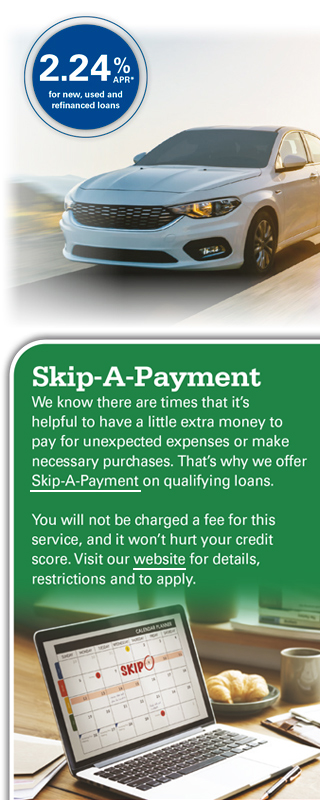

- Rates as low as 2.24% APR* for new, used, and refinanced loans.

- No payments until July 2020.

- You could win a $300 deposit when you apply by 5/31.**

- Get pre-approved for more buying power.

- Have a car loan somewhere else? Switch and save!

- Apply online or by phone.

- No prepayment penalties.

Your Car Buying Checklist

Whether you’re buying new or used, it’s important to make sure you get the best deal and secure a great loan.

Research your car online. Check out reviews and average selling price for the car you want.

Do a credit check up. You’ll qualify for a lower rate the better your credit history and score. You can get a free credit report from each of the credit bureaus every 12 months from AnnualCreditReport.com. Ensure that the information reported is correct and up to date. You can choose to pay to see your credit score.

Know your trade-in value. If you have a vehicle that you want to trade-in, use a site like NADA.com to research how much it’s worth.

to trade-in, use a site like NADA.com to research how much it’s worth.

Get preapproved before your shop – you’ll know how much you can afford. This will also let you negotiate the sale separate from financing.