Winner’s Corner

- Heather Hughes from WV won $300 during our spring auto loan promotion.

- Natalie Belton from SC won $100 in our quarterly new member drawing.

- Teresa Donald from VA won $150 during our Spring Into Fun giveaway.

- Ramona Truslow from VA won $300 during our Credit Card Balance Transfer campaign.

5 Smart Ways to Use Your Home’s Equity

Borrowing using the equity in your home is a great lower rate option if you’re looking for the flexibility of a line of credit with the ability to pay it back as you would a credit card. With a Home Equity Line of Credit (HELOC) you can keep your monthly payment low by withdrawing money only as needed, and you only pay interest on what you borrow.

A few smart ways to use a HELOC are to:

- Pay for home renovations or spruce up your yard

- Consolidate debt

- Pay for taxes

- Help pay for college expenses

- Pay for large expenses like a wedding

Our Home Equity Lines of Credit have no minimum balance requirement and no annual fee. Plus, you can pay contractors directly with checks from your line of credit. Give us a call and let us help you get started today!

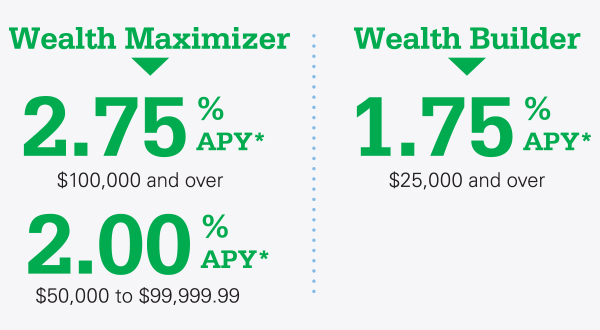

Boost your Savings with Higher Rates and Flexibility

Money Market Savings

Enjoy competitive high rates with the ability to withdraw or add funds whenever you like. Plus, our Money Market Savings accounts are federally insured, making them a great, low-risk option.

Sign up for automatic deposits and your money will grow even faster. Fuel your savings and open up your Money Market Savings today.

*APY=Annual Percentage Yield. Rates effective July 1, 2023 and subject to change. Call for current rates. Dividends calculated on average daily balance.

Keep Your Money Safe! What to Watch Out for to Avoid Scams

- Fake checks: When selling something on platforms such as Facebook Marketplace, if you’re given a check for payment, ensure the bank is legitimate, the amount is correct, and there are no smudges or discoloration. Try contacting the bank that the check is drawn on and asking to verify funds.

- Fake ads: Avoid clicking on unfamiliar ads. Many may be linked to fraudulent websites or infected with malware.

- Phishing email: Hackers may send fake emails requesting financial or personal data.

- Fake websites: Many scammers create fake websites by replacing a letter like a “L” with a “1” or “O” with a zero.

- Charity scams: When donating, especially to GoFundMe’s, do your research to confirm it is real before giving your money.